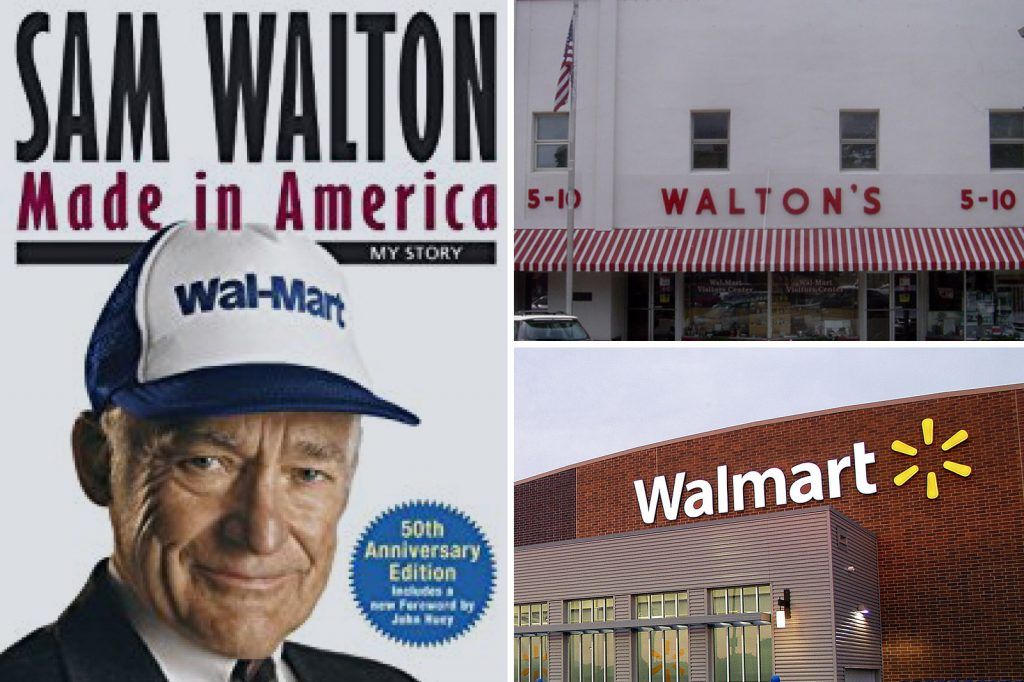

Over the last year I have read a significant amount of books from successful business magnates and icons. My most recent book is one of the best I have read it is, “Made In America” Sam Walton.” It is 2018 and it has been 26 years since Sam Walton passed away, but not before he left a legacy by building up Walmart the largest retailer in the world. Sam Walton was 100% self made and due to incredible vision and an obsession of testing new and innovative ideas was able to grow Walmart into the incredible organization it has become. What most people don’t know is that Sam Walton was able to establish hundreds of Walmart stores due to his ability to smartly finance the growth of his business, without the astute financing he would never have grown Walmart to the business it has become today.

Sam began his retail career by working a sales job at JC Penny’s and that was his first job right out of college. At that point he began to envision setting up his own store to manage. He was interrupted by world war 2 and served in the military for a few years and when the war was finished he knew exactly what he was going to do, he was going to set up a variety store in Newport, Arkansas. He had saved $5,000 himself and was able to secure a loan of $20,000 in order to start his business. The business began to grow immediately thanks to the innovative actions that Sam took. At that time Sam was building his first stores in smaller populated areas of Arkansas and in order to generate interested customers he needed to do new things. So what he did was discover that soft ice cream was going to help attract a lot of customers to his store, so he immediately secured a bank loan for $1,800 and set up the ice cream machine out in front of his store. It was unprecedented at the time and the machine led to significant growth in his store.

Over the next several years Sam Walton borrowed to the “hilt” as he described it in order to set up more stores and grow the business, at first he set up a couple of stores and later he began to set up dozens of stores each year, all while carrying significant personal risk to himself and his family by ultimately personally guaranteeing millions of dollars in loans and this was back in the 1950’s and 60’s when a million dollars was a decent amount of money. The point I’m making is that without his intelligence in securing significant funding from multiple banks and lenders all across the country Walmart would never have become the most dominant retailer in the world that it is now. So while some people like Mark Cuban may have said it is “stupid” to start a business on a loan, in reality most successful businesses are started by securing affordable financing and the majority of businesses are able to grow with capital secured by smart financing. Well, when Sam passed away he was far and away the wealthiest man in the world, and if he were alive today his wealth would total $160 Billion dollars which is more than what the current richest person in the world is worth although Jeff Bezos is on his way to breaking that mark.

Indeed, smart financing is a vital key for most businesses to get off the ground and grow into a long term sustainable business.