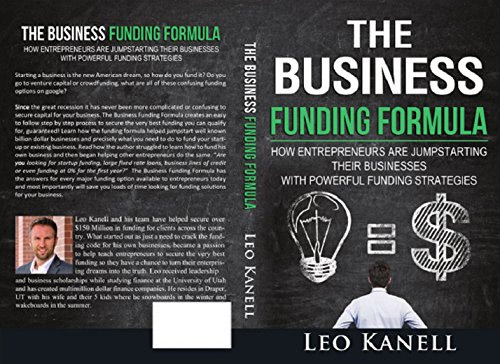

You’re an Entrepreneur or aspiring entrepreneur and you understand that at some point, especially at the beginning or at key points during your entrepreneurial journey, you will need funding to jump start your business. Access to money to jump-start your business is an opportunity, so I’m telling you there’s a chance when you discover the formula that will lead you to the funding you need. Knowing about something and being able to actually do it are 2 Different things. We might think, oh I will simply go to my bank, grab venture capital or crowdfund my way to success. Talking about it, knowing about and actually understanding how to execute funding to success is different.

The business funding formula is the holy grail for jump starting your business. So many ivy league studies show that one of the top reasons businesses fail is lack of capital or funding. Doesn’t matter what business you are in, what business model you have, you need capital. Even a lemonade stand needs the table, the lemonade, the cups, the sugar, the signs to get going. The BFF allows you to get the things your business needs like inventory, a new website, office location, money for marketing and the ability to hire staff. This is not get rich quick just because you got access to affordable funding. You need to focus on generating revenues and selling your product or service, but the BFF can open the door.

This is not buying a shelf corporation or spending 12 months building business credit to get a 1k Staples card, this is real world cash funding strategies that you can use to fund your business now. Is Venture Capital or CrowdFunding an Option? Both venture capital and crowdfunding Fund less than 1% of businesses, even with those 2 funding options, you often face additional hurdles that require additional capital beyond vc and crowdfunding if you are fortunate to be in the small 2 to 3% of businesses that get vc money.

What about my local Bank. Tell most businesses no because most don’t show profits on paper and startups forget about it. What about the SBA programs? They all need 2 years of profitable business tax returns or collateral. Securing Funding for an existing business and especially a new business is difficult. Lending Before the Great Recession vs Biz Lending Now is completely different, the funding landscape is much more stringent. Learn the Business Funding Formula, it’s is a skill that you can and Must Learn. Harness the power of the business funding formula by SIMPLY Clicking Here to Apply for Funding and get qualified in minutes..